life insurance policy meaning

Life insurance is defined as a legally binding contract between a policyholder and an insurer in which the insurance company provides financial protection to. This final category is one of the life insurance criteria that might vary significantly and have a.

Life insurance is a protection against financial loss that would result from the premature death of an insured.

. Life insurance is an important plan for the unexpected it offers financial protection to your loved ones if you die suddenly by replacing your income. Not all insurance companies charge a policy fee but those that do generally use the fee to. It is sometimes called pure life insurance because unlike the permanent policy.

The cash value is built up through the amount paid in which if you pay 5 then you also accrue 5 in. The most common forms of. Life insurance rates are typically determined by age gender and physical health.

Life Insurance Policy Meaning. The named beneficiary receives the proceeds and is thereby. The insurance component pays a.

Whole life insurance is a contract with premiums that includes insurance and investment components. A term life insurance policy provides coverage for a specific period of time typically between 10 and 30 years. In a level term life insurance the coverage is usually set at 10 15 20 25 or 30 years.

If you purchased a 20-year level term life insurance for example with a fixed monthly. Cheapest whole life insurance rates what is whole life insurance whole life insurance rates whole life insurance information definition of whole life insurance affordable whole life. Life assurance is a type of life insurance policy that lasts indefinitely as long as you keep making monthly payments.

Whole Life Insurance Policy. Universal life insurance is type of flexible permanent life insurance offering the low-cost protection of term life insurance as well as a savings element like whole life. A term life insurance policy covers you for a number of years and then ends while a permanent life insurance policy usually lasts your whole life.

An insurance policy is a formal contract between an insurance company and the insured wherein the former party agrees to provide a certain service or pay out a certain. What is a Non-Life Insurance Policy. Life insurance is an agreement between the insured person Policyholder and the insurer Insurance company which states that the insurer has to pay a sum of money to the.

A paid-up addition is categorized as a miniature life insurance policy. That means that a life assurance policy is guaranteed to. A policy fee is an additional fee that the insured is required to pay beyond the policy premiums.

The definition of non-life insurance is the losses that are incurred from a specific financial event are compensated to the insured this is.

What Is Life Insurance Meaning Types Of Life Insurance Policy Getinsurance

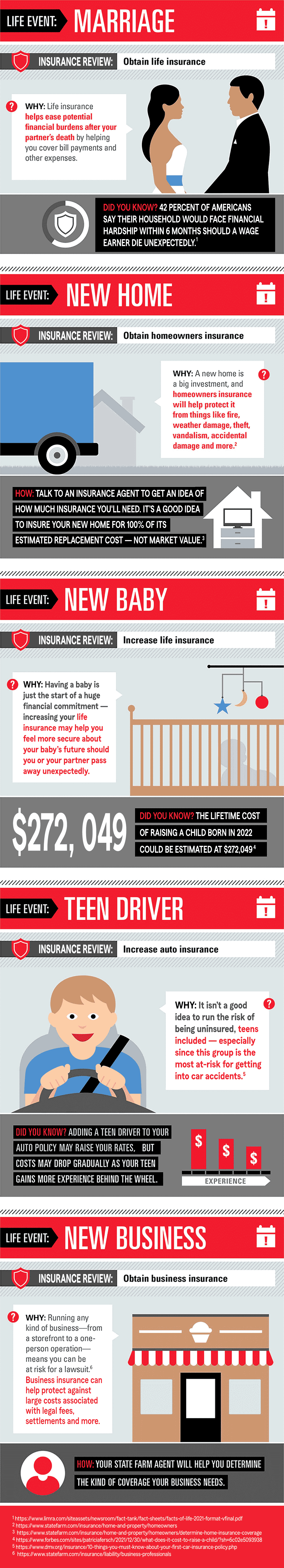

Times To Review Your Insurance State Farm

Joint Life Insurance Policy Meaning Types Features Benefits Of Joint Life Insurance Policy Paybima

Articles Junction Types Of Life Insurance Policies Life Insurance Definition Meaning

When You Outlive Your Whole Life Insurance Policy

Stacking Multiple Life Insurance Policies 5 Reasons To Stack

Health And Life Insurance Ppt Video Online Download

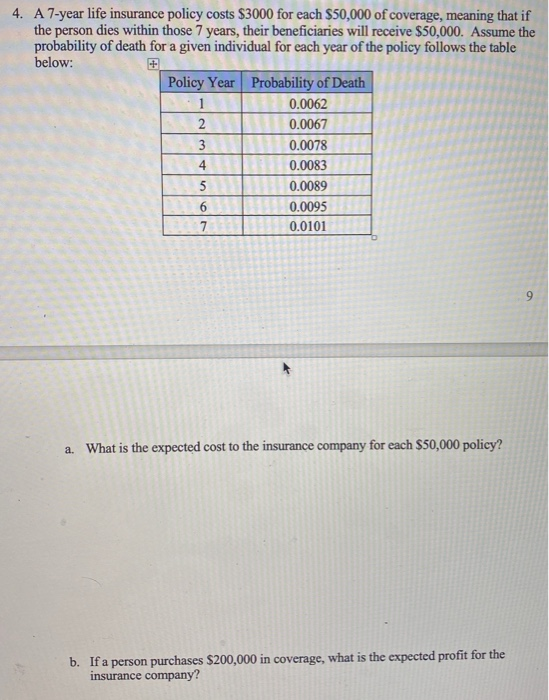

Solved 4 A 7 Year Life Insurance Policy Costs 3000 For Chegg Com

Life Insurance Products Terms Pdf Pdf Life Insurance Insurance

Types Of Term Life Insurance Which Is Right For You

Pwl Protection Whole Life Insurance Policy By Acronymsandslang Com

4 Details About Life Insurance Policy By Lifeinsuranceedus Issuu

What Does A Rider Mean In A Life Insurance Policy Mint

Guardian Life Whole Life Insurance Is The Most Common Type Of Permanent Life Insurance Policy Meaning Your Coverage Won T Ever Expire If You Pay Your Premiums Wondering If It S Right For

How Does Life Insurance Work Nerdwallet

What Is Life Insurance Life Insurance Meaning Definition

4 Reasons You Should Buy Whole Life Insurance Coupontoaster Blog

:max_bytes(150000):strip_icc()/Life-Insurance-Final-bcf4da30a2364d1180f00c12752f48a3.png)